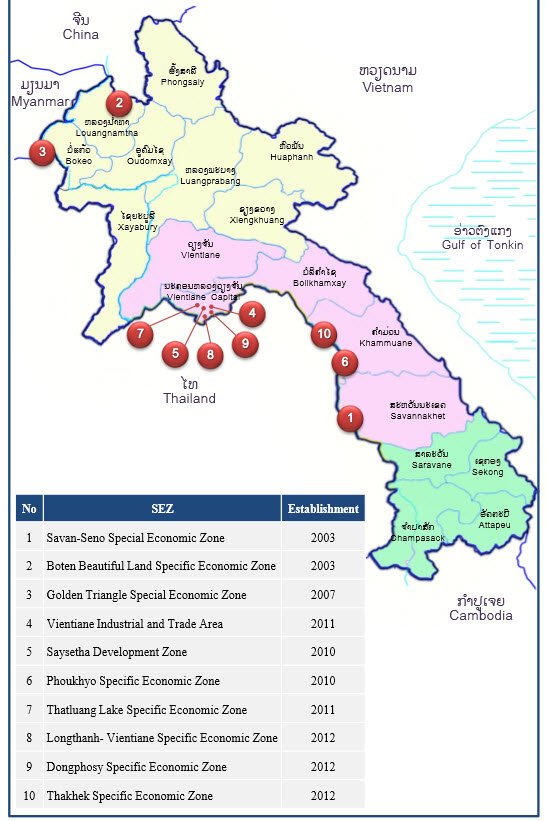

EZ Overview

Special Economic Zone and Specific Economic Zone (SEZ).

Special and Specific Economic Zone Development are forms economic development which identified specific locations to attract both domestic and foreign investors by

offering tax and duty incentives in order to promote infrastructure development, service, production, skill development and transfer modern technology. The overview of the SEZ development is to contribute into the rapid growth of the economy, regional and international integration, promotion of economic reform based on the market economic principles and characteristic of the country, implementation of progressive Strategy into SEZ development and management in accordance with “Small Administration Unit Wider Society” laying the foundation for gradual industrialization, turning land into capital and optimization of a State strategic location along the east-west economic corridor in order to graduate from LDC status by 2020.

Special Economic Zone

- The SEZ is determined to be developed in to a new and all-round modernized town; Community gets involved in the development;

- The SEZ is developed and managed according to “Smaller Administration Unit But Wider Society”;

- The Administrative Committee and the Economic Executive Board has full authority to manage SEZ;

There are 2 types of Investment :

– Government 100%

– Joint venture (Govt. And Private)

Specific Economic Zone

- The SEZ is Developed as industrial zone, processing zone, tourist area, free trade zone, high-tech park, etc…

- The SEZ is developed and managed according to “Smaller Administration Unit But Wider Society”;

- The Economic Executive Board has full authority to manage;

There are 3 types of Investment:

– Government 100%

– Joint venture (Govt. And Private)

– Private 100%

Why Invest in SEZ ?

Potentials and Opportunities for Investment in SEZ

- Peace and political stability;

- Rich in natural resources;

- Land available for SEZ development;

- Low price of electricity;

- Good policy and good incentive for SEZ development;

- Land link among countries in South East Asia;

- Prepare to become a member of the World Trade Organization (WTO) and Asian Free Trade Area (AFT);

- Plan for railway construction from China to Laos and link to other SEA countries.

Incentives for SEZ Investment

Developers and investors in the SEZ are entitled to receive the privileges as following:

- Receiving tax exemption for importing equipment and raw materials for construction;

- Receiving the reduction of income tax and value added tax, depending on business type;

- Receiving the right to reside in Lao PDR with family during the time of investment;

- Receiving other promotion privileges which are indicated in laws and regulations;

- Receiving one stop service at a zone.

Download investment overview of all 10 zones